Foreign investors have several possibilities for registering companies in Singapore. Among these, they can set up subsidiaries, branch offices, or representative offices.

A subsidiary is usually registered as a private limited liability in Singapore with a foreign company as a shareholder. For many small and medium-size foreign companies, the subsidiary is the most preferred business vehicle in Singapore. The registration procedure for a subsidiary is quite simple and only requires the approval of the company’s name and the submission of all required documents with the Companies Registrar in Singapore.

However, there are a few requirements for establishing a subsidiary in Singapore, among which:

- a Singapore resident director,

- a Singapore resident company secretary,

- the subsidiary must have a registered office,

- open a corporate bank account.

Another requirement is to deposit the share capital. For private limited liability companies, the minimum share capital in Singapore is 1 S$.

Documents required to open a subsidiary in Singapore in 2024

The following documents must be filed with the Accounting and Corporate Regulatory Authority (ACRA) when opening a subsidiary in Singapore:

- the application form issued by ACRA;

- the certificate of registration of the parent company;

- a document released by the Trade Register in the parent company’s home country showing the address of the company and the directors;

- a document appointing a local representative of the parent company in Singapore;

- the personal identification data of each director of the subsidiary;

- statements from the appointed directors in which they consent to their functions;

- the registered address of the subsidiary;

- the subsidiary’s documents of incorporation.

All documents must be filed in English.

Our specialists in opening companies in Singapore will draft the Articles of Association for opening a subsidiary in 2024.

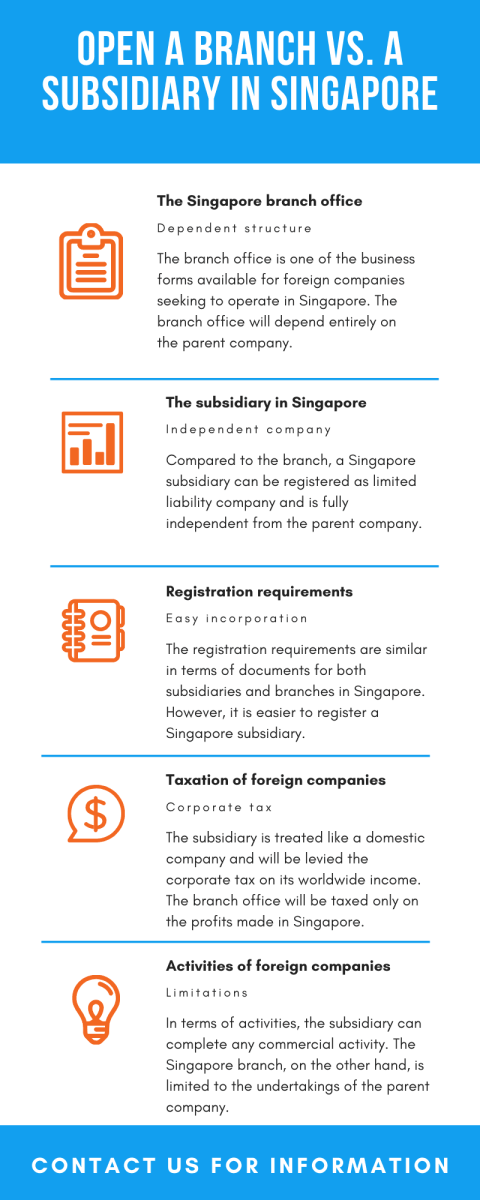

You can also read about the main differences between branches and subsidiaries in Singapore in the scheme below:

Registering a branch office in Singapore

A branch office represents an extension of a foreign company in Singapore and it must carry the same name as the parent company. Before opening a branch office in Singapore, you should know that the registration procedure of a branch requires appointing a resident agency that carry out the process, according to the Commercial Code in Singapore. Branch offices in Singapore will usually carry out the same activities as the parent company.

In terms of registration, the branch office must submit the name for approval with the Trade Register and once it is approved the Singapore company registration representatives will submit all relevant documents. Following the registration, the Singapore branch will open its corporate bank account and register for taxation purposes with the IRAS (Inland Revenue Authority of Singapore).

In order to register a branch office in Singapore in 2024, the representatives of the parent company must provide the following documents to ACRA:

- a certified copy of the parent company’s certificate of registration;

- a certified copy of the documents of the incorporation of the parent company;

- information on the directors of the foreign entity;

- a statement appointing a Singapore resident to act as representative of the branch office;

- information on the registered address of the Singapore branch office;

- the latest financial statements of the foreign company.

A comparison between Singapore subsidiaries and branch offices for 2024

Compared to the branch office which is an extension of the parent company, the Singapore subsidiary is a distinct legal entity. In terms of liability, the subsidiary will be held accountable for the company’s debts and actions, while the parent company will be held liable for the Singapore branch office’s debts. The branch office’s activities are limited to the parent company’s activities, while the subsidiary may carry out other activities than the parent company.

When it comes to the Singapore taxation system, branch offices will only be taxed on the income they make in the city-state. Subsidiaries are taxed as resident companies and benefit from all local tax benefits and double taxation agreements Singapore has concluded with other countries.

Find out from the video below the main differences between Singapore branches and subsidiaries:

What to choose: a branch or a subsidiary in Singapore?

Most of the time the representatives of foreign companies which want to open a Singapore company find it harder to decide between these two types of business forms: the branch office and the subsidiary. Our Singapore company formation consultants recommend they choose based on whether the company intends to undertake other activities than the parent company, in case the subsidiary is a better option. Taxation should be also taken into consideration, as the branch office will be taxed as a non-resident company and, therefore will not benefit from all the deductions available for subsidiaries in Singapore in 2024.

Economy of Singapore in 2024

As its trade-related industries gradually strengthened, the Ministry of Trade and Industry (MTI) predicted in November 2023 that Singapore’s economy would increase between 1% and 3% in 2024. The 2023 survey’s forecast agrees with MTI’s estimate of a GDP increase of about 1% in 2023. 57% of poll participants predicted better company profitability in 2024 based on key financial indicators than they do this year’s consistent profits. In 2024, 43% of respondents predicted a decline in the price of private residential real estate.

In terms of foreign investments, in March 2023, Singapore’s Foreign Direct Investment (FDI) climbed by USD 29.5 billion, below the USD 36.7 billion value in the previous quarter. In 2024, Singapore’s net inflow of foreign direct investments is expected to be approximately SGD 27.7 billion (USD 20.18 billion).

If you want to open a company in Singapore and need advice on the right type of company to register, please contact our local company formation agents.