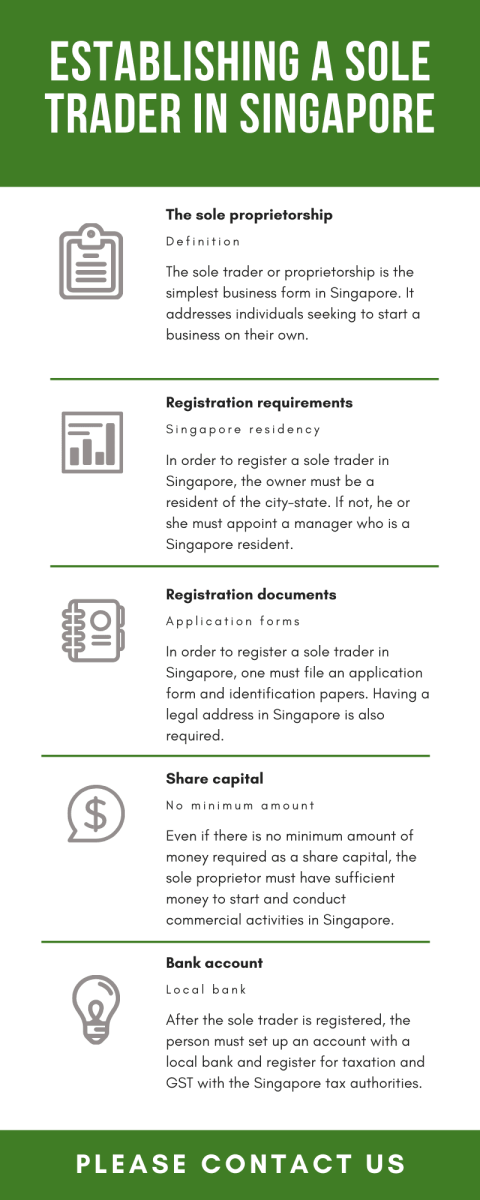

The sole proprietorship or sole trader is the simplest form of doing business in Singapore. The Singapore sole proprietorship is suitable for small businesses carried out by one owner. According to the Companies Law in Singapore, the sole trader is not considered a distinct legal entity, which is why the owner is fully accountable for the business’ liabilities. A sole trader requires at least one manager that must be a Singapore resident and must also have a registered address.

It is also important for citizens or holders of a Singapore residence permit to have enough money before going forward with the registration as a sole trader. In terms of taxation, the sole trader will be taxed on its income as an individual in Singapore. Sole traders making any changes to the status of the business must report the changes to the Singapore Companies Register.

Choosing a name for a sole proprietorship in Singapore

Sole traders and partnerships in Singapore are simple business forms which fell under the regulations of the Business Names Registration Law. However, at the beginning of 2016, this law was replaced by the Business Registration Law which now provides for slightly different requirements for those establishing sole traders in Singapore. These are:

- – the name must not be offensive or vulgar;

- – the name must be unique;

- – the name must not be restricted under the Companies Registrar’s requirements.

It should also be noted that ACRA may refer the sole trader’s proposed business name for approval with other governmental authorities.

Our company incorporation experts can explain what the new Business Registration Act 2016 contains and can help investors open a company in Singapore.

We have also created a scheme with the steps of opening a sole proprietorship in Singapore:

Steps and documents required for the registration of a sole trader in Singapore

In order to register a sole trader in Singapore, the following documents must be provided:

- – the business name,

- – a description of the activities to be carried out,

- – the business address of the sole proprietorship,

- – a copy after the owner’s identification papers,

- – the residential address of the Singapore sole trader,

- – a declaration of compliance and statement of non-disqualification.

The first step of the registration procedure is the approval of the business name followed by the registration of the sole trader. The procedure is quite simple, requiring only a day to be completed if all documents are correct.

Even if setting up a sole trader is easier, foreign businessmen are usually recommended to register a limited liability company in Singapore due to the tax facilities it can benefit from.

Are there any other steps to take after registering the Singapore sole trader?

Once the registration of the sole proprietorship is complete, the Accounting and Corporate Regulatory Authority will issue the registration number. Based on the registration number, the sole trader may open a bank account in Singapore and obtain an office lease if necessary. In order to open a business bank account, the sole trader will be required to submit a copy after the identity card, a print of the sole proprietorship’s business profile and a minimum deposit that depends on the bank.

You can also watch our video on how to set up a sole trader in Singapore:

Compliance requirements for sole traders in Singapore

As seen above Singapore citizens and residents are allowed to establish sole proprietorships on their own, however a foreign citizen which enters none of the options above must appoint a representative or Singapore company formation agents who will register the sole trader with ACRA. Moreover, foreign citizens opening sole traders in the city-state must appoint a resident director, for compliance purposes. If until recently a sole trader had to renew the registration certificate every year, it now may renew it every three years.

Another compliance requirement for opening a sole proprietorship in Singapore is to obtain the approval of the Housing Development Board in case the registered address is located in a public flat or house and from the Urban Redevelopment Authority in case the sole trader will carry out its activities in a private household.

From an accounting point of view, sole traders are not required to have their accounts audited or file annual tax returns. However, they are required to file yearly income returns and keep their accounts for at least five years.

For information about the advantages of setting up a sole trader you can contact our specialists in company incorporation who will help you open a company in Singapore, no matter the legal structure you’ve chosen.

Furthermore, businessmen interested in setting up this type of company in a European country, for example in Estonia, can find out more details on how to start a company in Estonia from our local partners. If you are interested in setting up a company in Austria or registering a company in Serbia,we can also help you with information from our affiliate partners. In case you need professional company formation services in Switzerland, you can contact our partners – Experten in Firmengründung in der Schweiz. We can also put you in touch with our partners in UAE if you want to hire a special Ferrari in Dubai.